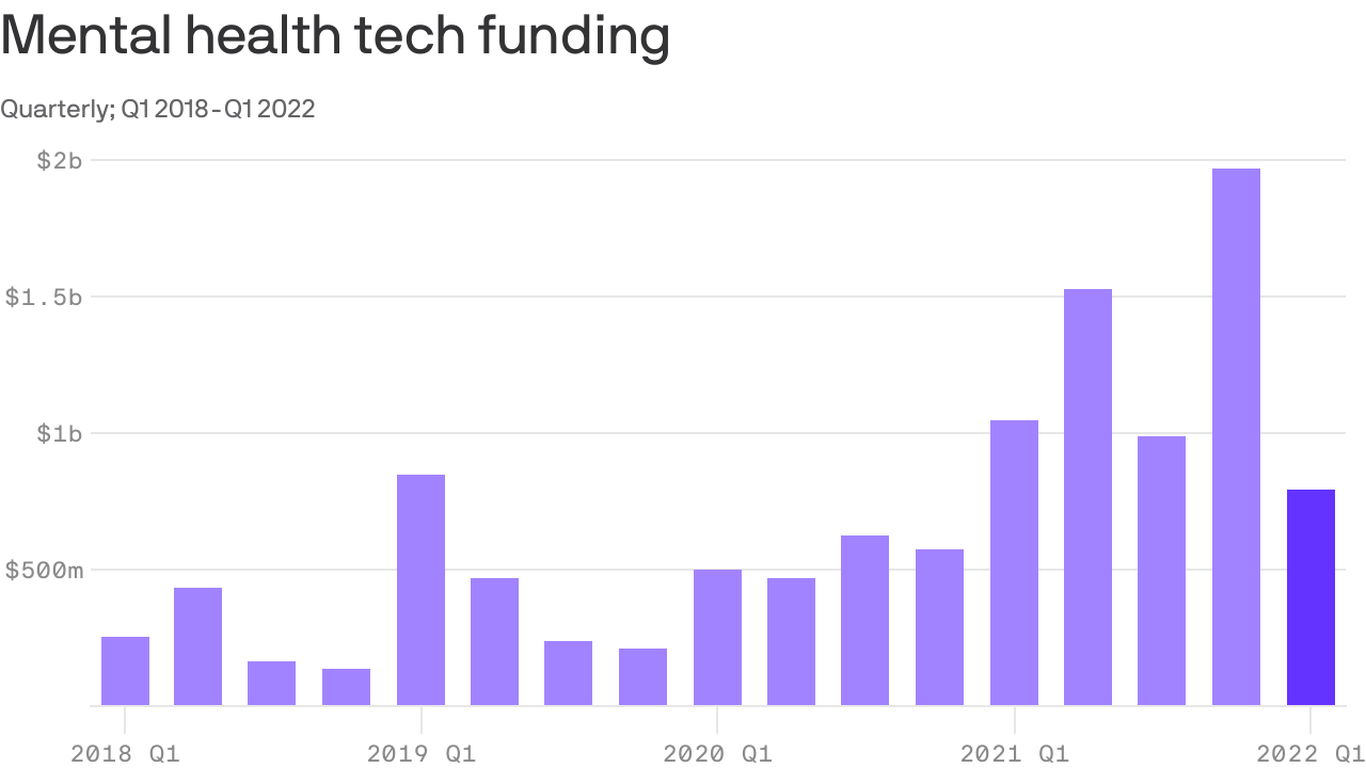

Although Increasing demand for behavioral health services, funding for the mental health tech sector plunged 60% from the last quarter of 2021 to the first quarter of this year, a recent figure report of CB Insights reveals.

Why it matters: Since the pandemic began, the number of people seeking behavioral health services has it shot itself — however, even with an increase in the number of apps and tools available, demand has continued to rise. leave behind supply.

- The problem, already perceptible before the pandemic, has only got worse in recent years.

- The young in particular are suffering at levels worrying enough to prompt the American Academy of Pediatrics to to declare the topic a national emergency last fall.

By the numbers: The behavioral health technology sector raised $792 million in the first quarter of the year, a significant downturn from the $1.96 billion raised in the fourth quarter of 2021, according to the report’s authors.

- The number represents the lowest funding level for the sector since the fourth quarter of 2020.

- As a percentage of total digital health funding, the figure also fell, from 12% in the fourth quarter of 2021 to 8% in the first quarter of 2022.

- Still, US-based startups raised more for telemental health than those in any other country, securing 84% of the total.

Context: The drop in funding for telemental health comes as part of the biggest recession in the financing of digital health, which had previously been in a tear of a decade.

- While it’s unclear exactly how the decline in funding will affect companies in the sector, a number of behavioral health tech companies, including addiction treatment startups, were shuttered this quarter. Health Alcyon and ADHD medication provider Ahead.

The other side: Despite the funding cut, several new types of mental health startups emerged this year, including companies specifically for the workplace and youth. For example:

- Paraclete, creator of an employer-oriented wellness offer, raised $1.5 million in pre-seed funding in February.

- Daybreak Health, a school-oriented care startup, raised $10 million in Series A funds in March.

Some of the more established telemental health companies also raised large late-stage funding rounds in the first quarter of the year, including:

- Lyra Health raised $235 million in Series F funding in January.

- Brightline raised $105 million in Series C funding in March.

- Also in March, Brightside Health (no, not Brightline) raised $50 million in Series B financing.

The bottom line: While the drop in mental health tech funding is worrying given the surge in demand for therapy, it’s less surprising when considered as part of the overall drop in digital health funding.

.