India is slowly but surely recovering from the effects of the pandemic, with mental health and happiness at the top of everyone’s list, according to BankBazaar’s 2022 Aspiration Index, which recovered to pre-Covid levels. , removing the impact of Covid on the index.

This year’s data points to a resurgence in aspirations despite harsh post-pandemic inflation. The all-India aspiration rate now stands at 87.3, reaching its highest level since the start of this study in 2018, when it was 87.4.

The index is up sharply from 84.4 in 2021 and the all-time low of 79.9 in 2020. The recovery shows that India is truly back on the task of chasing her dreams.

This year’s Index grew 2.9 points compared to last year, although led by non-material aspirations such as Health (89.5) and Relationships (87.9). Interestingly, individual goals diverged sharply, indicating a clear divide between what India wants and what it thinks it needs.

GREAT CITIES, GREAT ASPIRATIONS

Metropolitans continue to lead non-metropolitans in aspiration. At 2.6, the gap between metropolitan and non-metropolitan areas is the highest in history.

this one drives

The East regained its crown as the region with the most aspirations, closely followed by the West. A comparatively moderate impact from Covid over the past few years has helped the region maintain aspirations despite the impact of inflation.

Also read: How to spot errors on credit card bills

WOMEN HAVE HIGHER ASPIRATIONS

Women continue to be ahead of men in terms of aspirations, with an advantage of 3 full points. Women of all ages have more aspirations than men, and Moneymooner women lead the pack, an indication of changing times and social mores. Jobber’s first men are the least aspirational. Wealth is the most important aspiration for Moneymooner women, but the least important for Wealth Warrior women who put fame and personal growth before wealth.

Mental wellness is top priority

Mental well-being is the main objective by sample size, as well as by aspiration. But there is a clear difference between what young Indians want and what they prioritize. The top five most popular life goals highlight what Indians wanted most: to be happy and healthy (49.2%), see the world (44.1%), be their own boss (34.1%), save for their children’s education (37.9%) and splurge on the finer things in life (31.3%).

However, the more aspirational goals are different and reveal the heart of young India. While mental health and saving and investing for children are in the top five, what matters most is living close to family, eating well and, of course, owning a home.

Adhil Shetty, CEO of BankBazaar.com, explains this divergence: “After more than two and a half years of emotional and financial distress, people are eager to recapture their former lives and fulfill aspirations that were delayed due to Covid. However, the realities of the post-COVID-19 world, and the rising inflation and global instability that come with it, are forcing people to take a more pragmatic and measured look at how they do this. Consequently, we are seeing that people prioritize their goals more than ever.”

OBSTACLES TO ASPIRATIONS

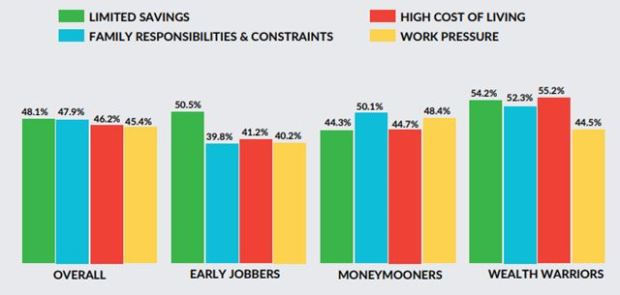

Limited post-pandemic savings coupled with the high cost of living are barriers to India’s aspirations. The weak points of each age cohort clearly emerge. Early workers face severe job losses and savings depletion during Covid years; nearly half lament the lack of savings. Moneymooners are torn between family responsibilities and work pressures in a rapidly changing world. And wealth warriors are sidetracked by the high cost of living and depleted savings.

Impact of inflation

Households across India present a difficult picture. Expenses have increased for 77% of those surveyed in the last year. The warriors of wealth, with greater liabilities and greater responsibilities, feel the heat the most. Meters (79%) feel the pinch more than non-Meters (72%). Consequently, reliance on credit to cover monthly expenses increased for 62% of respondents, and savings stagnated or decreased for nearly 80%.

“Despite inflation, people remain focused on their priorities. The study shows that 57% of people took a loan in the last year. Of these, almost half have taken out a loan to invest in a house (49%) or vehicle (43%). About 35% are to finance higher education and 26% to improve housing. When you read this together with the overall high Aspiration Index, it indicates India’s determination to overcome challenges in pursuit of its goals,” explains Shetty.

Pandemic-Induced Savings Reduction

One of the most adverse effects of the pandemic has been a reduction in savings, largely due to job losses, medical expenses and increased cost of living. 47% of respondents reported a drop in their monthly savings, while 32% said they were unable to increase their savings. While respondents from all age cohorts have seen a drop in savings, the decline has not been the same for everyone. Among women, Early Jobber and Wealth Warriors saw a larger drop in their savings compared to Moneymooners.

One of the notable trends highlighted in this index is a growing interest in non-traditional forms of investment, specifically cryptocurrencies. 32% of the respondents invested in cryptocurrencies, of which 38% consisted of Early Jobber women.

credit awareness

Credit awareness among this cohort continued to be high. Close to 90% know what a credit score is and 80% have checked their credit score. More than 73% have seen their scores remain stable or increase in the past year.

retirement planning

Early retirement is one of the top five goals for 29% of respondents, making it the sixth most preferred goal. Retirement planning is the second most important reason to invest. Despite this, only 60% have a retirement corpus. Only 22.1% say they are out of the way.

!function(f,b,e,v,n,t,s)

{if(f.fbq)return;n=f.fbq=function(){n.callMethod?

n.callMethod.apply(n,arguments):n.queue.push(arguments)};

if(!f._fbq)f._fbq=n;n.push=n;n.loaded=!0;n.version=’2.0′;

n.queue=[];t=b.createElement(e);t.async=!0;

t.src=v;s=b.getElementsByTagName(e)[0];

s.parentNode.insertBefore(t,s)}(window, document,’script’,

‘https://connect.facebook.net/en_US/fbevents.js’);

fbq(‘init’, ‘444470064056909’);

fbq(‘track’, ‘PageView’);

.