In this weekly series, CNBC takes a look at the companies that made the inaugural Disruptor 50 list, 10 years later.

Back in 2013, the idea of a mental health care app may have seemed novel, if not monumental in terms of a global challenge for a disruptive startup. But times have changed. A global pandemic that’s led to a massive rise in mental health challenges and accelerating adoption of tech-enabled healthcare make what startups like Ginger.io set out to do more than a decade ago seem rushed ahead. At your time.

Globally, the World Health Organization estimates that approximately one billion people are living with a mental disorder, with the vast majority of people in low- and middle-income countries where mental, neurological and substance use disorders do not receive any treatment. The imbalance between supply and demand for mental health care increased since the Covid-19 pandemic. A Lancet study estimated an additional 53 million cases of major depressive disorders and an additional 76 million cases of anxiety disorders globally in 2020.

Ginger.io, which grew out of an MIT Media Lab team focused on aggregating and analyzing healthcare data, was featured on CNBC’s inaugural Disruptor 50 list in 2013 for leading the way in creating an on-demand digital mental health system. and based on data. ecosystem. That became a unicorn in 2021 after a $100 million funding round led by Blackstone.

At the time of the deal, Ginger reported revenue that had tripled year-over-year for three straight years and more than 500 employer clients, including Paramount, Delta Air Lines, Domino’s, SurveyMonkey, Axon, 10x Genomics and Sephora, as well as dealing with the corporate healthcare concierge company Accolade and upstart online pharmacy Capsule.

The company said demand for its services tripled during the pandemic, but as the scale of the mental health care problem has grown, startups tackling it have also had to scale. In late 2021, Ginger merged with an app-based business that many people looking for a bit of calm during Covid had come to know about: meditation app Headspace.

The $3 billion merger of Headspace Health and Ginger was part of a larger consolidation trend within the digital health care space and the movement of disparate health technology companies to roll out a full suite of services under a familiar model. as value-based care. Other CNBC Original Disruptors: Castlight Healthwhich merged with Vera Whole Health, and Audax (now part of health giant UnitedHealth’s Optum tech business), were among a recent wave of deals between some of the best-known health tech startups. Virgin Pulse and Welltok. Accolade buying PlushCare. Grand Rounds and Doctors à la carte. Teladoc and the chronic care company Livongo.

The combined Headspace-Ginger entity reaches nearly 100 million lives in more than 190 countries through direct-to-consumer businesses and more than 3,500 business and health plan partners.

“The increase in need is staggering,” said Russell Glass, CEO of Headspace Health. “You have passed 20% of the [U.S.] population with a need at 40%, thus a doubling of those with acute anxiety, depression, or other mental health need.”

Headspace Health clients include Starbucks, Adobe, Delta Air Lines and Cigna.

“Mental health is clearly a global challenge,” said Karan Singh, chief operating officer of Headspace Health. And it’s a challenge that includes the complexity of the business, from different regulations around the world to language-based needs. “Everyone may use different language to describe the things they’re going through, but this is something most people are going through,” Singh said.

In the US, as the pandemic continues and regulations evolve, Headspace Health faces the challenge of getting policymakers to consider telehealth in the same category as traditional health care.

The Biden administration is focusing on mental health among other health care priorities, including plans to ease restrictions on practicing virtually in multiple states, a step Glass said is long overdue and critical to building a mental health infrastructure that is economically, racially, and geographically equitable. .

“Resolving this crisis should and can be our next JFK moon moment,” Glass said.

“I think we’re going to need some structural changes to ensure that some of the gains we’ve seen in recent years really persist,” Singh added.

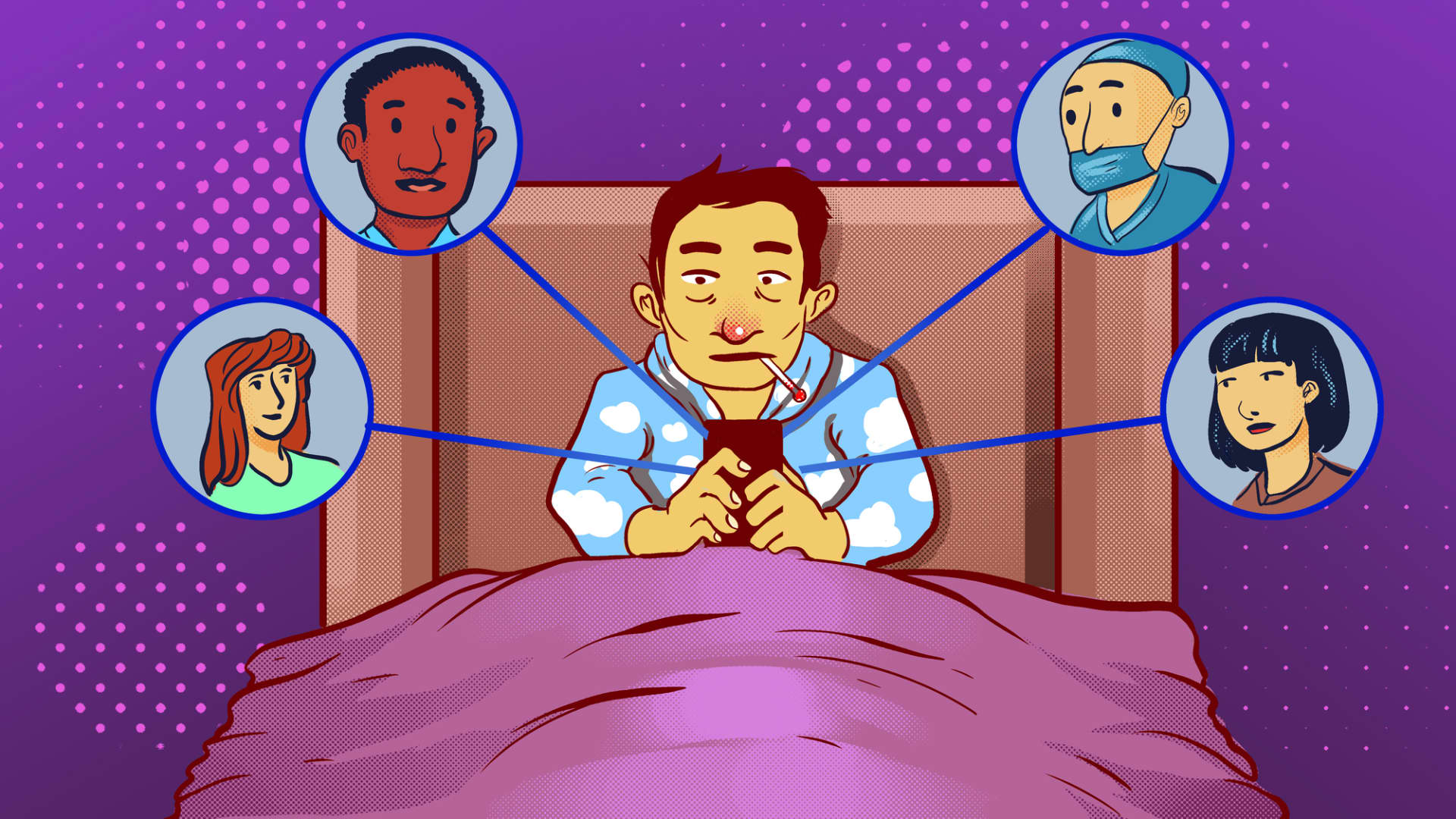

Virtual care has become a powerful and effective way to access care, with many people preferring it to in-person care, or at least having the option.

“The cat is out of the bag,” Glass said. “As consumers realize how amazing telehealth is, and as government agencies increasingly listen to those consumers, we’ll see changes happen.”

Glass compares Headspace’s current regulatory fight to the one facing Uber and cites how consumer preferences inspired regulatory change.

But the digital health space faces more acute market challenges, with its post-pandemic playbook in question, highlighted by this week’s disastrous earnings results from teladoc, which included a writedown of more than $6 billion related to the Livongo acquisition. Some of the biggest names to go public associated with digital health have seen their public market values decimated over the past year, including Teladoc, His and her healthY american wellas basic telehealth services become commoditized and the market opportunity among corporate buyers and insurers willing to pay more for a full suite of digital health care looks less certain.

Headspace Health sees room for both competitors and more deals.

“We want to transform mental health care to improve the health and happiness of the world. We won’t do it alone,” Glass said. “A healthy competitive environment is critical to achieving what we want to achieve.”

At the beginning of this year, Headspace acquired Sayanaan AI-powered wellness company, further increasing the breadth of services and scope of care in its portfolio.

As you try to increase access to mental health care services, the ultimate goal is to reduce costs.

“How do we eliminate the cost of care? How do we prevent people from needing higher levels of care?” Glass said.

Singh provided the answer. “Focus on prevention. Ultimately, that’s the only way out of this,” he said.

—By Zachary DiRenzo, special for CNBC.com

Sign up for our original weekly newsletter that goes beyond the annual Disruptor 50 list and offers a closer look at companies like Headspace and entrepreneurs like Glass and Singh who continue to innovate across all sectors of the economy.

.